We are here to discuss about education loan from Axis Bank. Axis bank is one of the leading private bank of our country that is India. In terms of asset management it is the third largest private bank in India and by market capitalisation it is in fourth spot through out the country. Axis bank which was earlier known as UTI Bank , Its headquarters is based in Mumbai, the financial capital of Mumbai with have over 5697 branches in thirty four Union Territory and States.

Education loan is one of the important loan which not only helps in individual growth but also helps the nation to grow having more skilled and educated citizens which helps in the growth of economy. Axis Bank provides education loans in different higher study programs that is diploma, bachelors, masters etc.

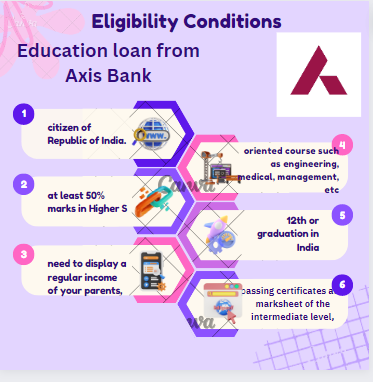

For availing education loan from Axis Bank individual should have following eligibility conditions :-

1) The primary condition is that you should be a citizen of Republic of India.

2) You must have scored at least 50% marks in Higher Secondary course or in graduation.

3) Loan will be provided to those who will pursue career oriented course such as engineering, medical, management, etc.

4) Should have secured admission through entrance/ merit based examination after class 12th or graduation in India or foreign based institute.

5) There is need to display a regular income of your parents, guardians, siblings, etc.

Documents Required for education loan from Axis Bank :-

1) There is need to submit Know Your Customer (KYC) Documents.

2) Individual is required to submit bank statement or bank passbook of last six month.

3) Guarantor Form that means means a person is guarantee for individual loan payments. (Optional, I . e, it is not compulsory).

4) You are required to submit a copy of admission letter of the university, college institute etc. and also required submission of fees receipt and fees book of the following course.

5) Also required to showcase and submit the passing certificates and marksheet of the intermediate level, secondary level or degree.

6) Individuals identification card so that Axis bank can verify the individual any of one documents that is Voter ID card / Driving License / Aadhar Card , etc. for your legal name and address.

7) Showing all authentic details to the Axis Bank.

8) Required Documents submission for the proof of the income (For Salaried Employees)

Necessary Documents Required for the first Payment of institute :-

1) The agreement of loan which is signed by the loan seeker.

2) Demand letter from the institute that is college or university where you took admission into.

3) The Loan Sanction letter which is attested by applicant.

4) If it is applicable then submit the security fees documents.\

5) You will get receipt when you will submit fees in college or university you need to submit this to Axis bank along with statement of bank which shows transaction.

6) Processing Fees for the Loan through AXIS Bank

Processing fees for education loan for admission in institute that is university or country up to 0.76% of the loan amount or some thousand and applicable taxes which is time to time change by government which ever condition is highest..

7) For getting more about Conversion price visit near by Axis Bank Limited branch.

*If your cheque is bounced of equally monthly instalments then you have to pay additional rupees five hundred only in addition to taxes as per revised and updated by government.

There are various government subsidy for education loan visit in local government educational body or in Axis bank.

Also if you are female you will provide some interest rate benefits.

Pros and Cons of taking Home Loan from Axis Bank :-

Pros :-

1) The interest rate charges in education loan is quite less as compared to other charges. You will get more benefits if you choose education loan over other sources of finance. The present interest rate of the education loan of Axis Bank is starting from up to 4 lakh is 8.7%, from 4 Lakh to 7.51 Lakh is 8.2% and loan greater than 7.51 Lakh is 7.2%. although the floating rate is applicable

2) Individual or individuals parents / guardians / siblings get tax benefits according to section 80 E of income tax in 1961. Certain percentage of income is exempted or discounted from toll tax.

3) It helps to built your CIBIL score which stands for Credit Information Report. It helps you to get good credit points which give advantage of further loans such as car loan, home loan or any other loan.

4) There is no need to give Axis Bank individuals valuable asset in banks custody. Without submit of any valuable asset you can get loan from Axis Bank.

5) As the individual will earn after completion of course you can liberate or free your parents from your education expenditures / finances.

6) Few documents and easy steps to get educational loan from Axis Bank.

7) Behaviour of employees and their services is excellent, so the education loan process will be comfortable to you and will be non hectic and gives you less or almost nil burden to you.

8) In Axis Bank the approval especially for the education loan is very fast. With in a few days you will know that your loan of education is approved.

9) After your course and joining the job you can comfortably submit your easy instalments on monthly basis.

Cons :-

1) The first disadvantage they required more documents. Sometimes it will create a negative impact to the individuals.

2) The Axis Bank is indirectly under control of Reserve Bank of India compared to other Nationalised/ Government bank they are directly under control of Reserve Bank of India. 3) There is floating rate of interest in Axis Bank, it is not fixed.

Frequently Asked Questions :-

1) What is interest rate of education loan in Axis Bank at present?

Ans:- It is about 8.7%, 8.2%, 7.2% depending upon loan amount.

2) Give me Toll Free to talk to customer care about home loan from Axis Bank. Ans:- the toll free number is 18604195555

3) What are documents needs for Identity for bank?

Ans:- Any one the one that is Aadhar Card, Pan Card, Voter card and others

2 Comments

Moses Godwin Peter · 13/08/2023 at 9:24 PM

I really need this loan

Tuguma amon · 04/09/2023 at 11:52 AM

Interest is to high