Yes bank is Indian origin company which is related to finance / banking sector. The founding members of the axis bank were Rana Kapoor and Ashok Kapoor in year 2004 and the Yes Bank headquarters is based in New Delhi, the capital city of India.

The Yes Bank’s major work is related to current and saving accounts, fixed deposits (FD) of customers, investing money in different fields and providing loan in such fields like business loan, personal loan, car loan, home loan, educational loan and lot more other in other domains.

Car loan is the main objective of the people who are present here to get information about to procedure required to get the car loan from Yes Bank.

Car loan is a loan related to vehicle purchase, when you purchase a car many individual do not have full value of amount to purchase a car in one go so here banks come and provides you loan for cars in simple rate so that you can repay the loan by easy monthly instalments.

The car loan is one of the famous loan at present time and axis bank offers you a lucrative car loan offers.

When you scroll this page down, you will get complete details related to eligibility conditions, documents required, pros and cons of car loan, where to apply for the car and many other knowledgeable facts which you have to remember while borrowing the car loan.

Eligibility Condition for Availing car loan :-

1) The age of individual in criteria of at least twenty one years and maximum sixty five years.

2) You must be salaried or self employed professional or self employed non professional.

3) The loan seeker must have regular source of income by any means such as employers or self run businesses.

4) ₹ 3,00,000/- per annum salary is minimum requirement of salaried person and for other person the minimum requirement of Salary is ₹ 2,00,000/- per annum.

5) You should have at least complete one year at your present job.

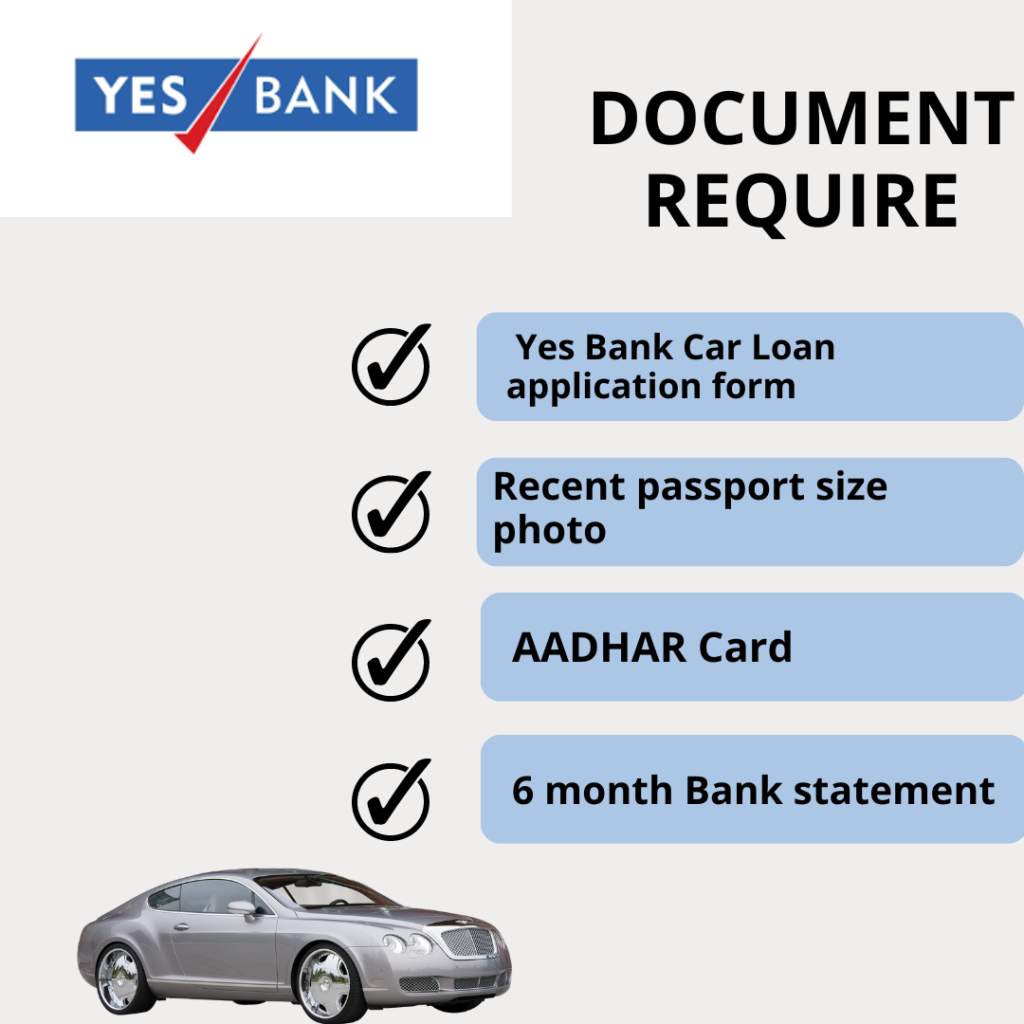

Documents required for availing Car loan from Yes Bank :-

1) First of all fill application form whatever is asked in Yes Bank Car Loan application form.

2) Two latest colour size recent passport photographs of car loan seeker.

3) As per Yes Bank policy you are required to submit the Know Your Customer (KYC) document.

4) Identification proof such as pan card, Aadhar car, voter identity car, driving license or any other valid document authorised by government.

5) You are required to submit valid proof of residence such as electricity bill, Aadhar card, PAN card or any other valid identity card authorised by the government authorities where there is written the address of loan seeker.

6) You have to bring last six months bank statement.

7) Also required to submit Income Tax returns of Income Tax Department ( if applicable).

8) For self employed person or business person you have required to show last three years of income tax returns and also required Balance sheet audited by char tent accountant (CA) which includes all loss and profit account.

For more details visit at YES BANK website www.yesbank.in or download the application of YES BANK from play store or apple store or visit to the nearest Yes Bank branch.

Yes Bank lend you loan up to 90% of the total cost of car and 10% amount downpayment done by customer.

The Yes bank provides quite lucrative and competitive rate of interest starting from 9.7%.

Loan Seeking customers are advised to thoroughly read all the documents carefully and understand the terms and conditions which is given by Yes bank.

The repayment of the car loan tenure is generally from one year to seven years.

Processing fees is less as compared to many other banks , the yes bank charge processing fees for car loan is just 0.4% of the total loan amount.

There are no foreclosure charges after one year but for starting 12 months up to 2% charge is taken as foreclosure charges.

Advantages and disadvantages of availing car loan :-

Merits :-

1) The rate of interest of car loan is much affordable and cheaper than other cash loan.

2) Through car loan you can achieve your dream car without having total money of cost of car, in India as we all know car is treated as luxury and status symbol.

3) The banks believes you that’s the reason that car loan is given by the bank to you if you do repayment of your EMI on time then it increases the faithfulness of Bank upon you. And your credit score will be improved, from this you can borrow loans later with out any difficult procedures.

4) Banks provide car loan for used cars as well. Yes Bank provides car loan on for both new cars and the old cars.

Demerits :-

1) The banks required lot of document which creates a hassle to the borrower, due to this there is wastage of time of the borrower.

2) Bank wants mandatory AC insurance, if car got damaged it is payable by the insurance company / organisation.

3) Due to easy availability of loan, many people can not maintain the car, as even cheaper car required a good maintenance cost. Their most of income dedicated to refuelling and maintenance like service, car washing and many other.

4) If you took loan of car from the bank, then Banks name will appear on the registration certificate of the vehicle as the owner of car is also bank along with you, you can not sell car without bank’s permission. If bank will giver permission, then only can sell the car.

Frequently Asked Question (FAQ) related to the car Loan :-

1) What is current rate of interest of car loan of Yes bank ?

Ans:- the interest rates are changing time to time at present interest rate starting from 9.7%.

2) What is contact number / customer care number of Yes bank ?

Ans:- 1800 1200 is the customer care number of the Yes bank.

3) Is borrowing car loan from Yes Bank a good deal ?

Ans:- It all depends upon different conditions, if your condition in your favour you can borrow car loan from Yes Bank. for more details read out this article or visit at www.yesbank.in or nearest branch of Yes Bank.

0 Comments